There are two main methods of data conversion, moving your data from one system to another, and you need to know the difference. Why? Changing or upgrading software systems is a huge decision! You should know what data you’ll be able to access in the future before you purchase new ERP software.

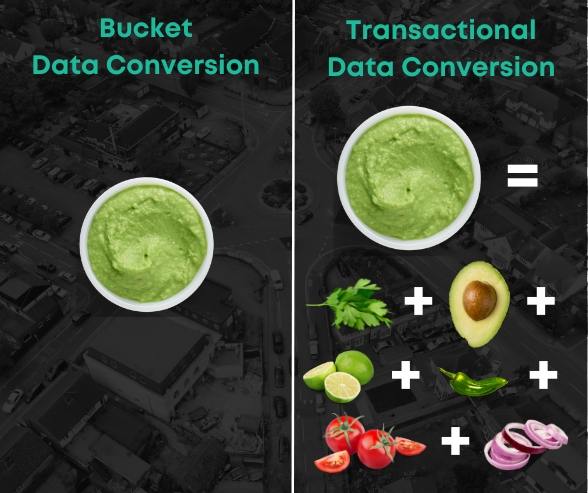

The two methods are bucket data conversions and transactional data conversions. They are two different approaches to data migration during a system implementation or upgrade. In simple terms, it’s how your information is taken from one system and put into another one.

The Differences

Scope

A bucket conversion involves moving data in batches, or buckets, which are normally based on predetermined categories. This leaves you with lump sum numbers to go off of. On the other hand, a transactional conversion moves data one transaction at a time, consisting of the details that make up that lump sum. For example, in financial data conversions, a bucket conversion would supply a lump sum for each month and a transactional conversion would detail each record that adds up to the monthly sum.

Complexity

A bucket data conversion is usually simpler and less time-consuming than a transactional data conversion. This is because the data is moved in bigger batches, which reduces the number of records that need to be migrated. A transactional data conversion is more detailed and complex, but requires more time. These are more useful when navigating through an audit or more detailed reports because each record is available to view. If your previous vendor is unable to provide you with a detailed conversion file, then a bucket conversion may be your only option.

Data Integrity

A transactional conversion guarantees higher data integrity because each transaction is verified and balanced before being moved to the new system. Both conversion types allow you to go back to any point in time for reporting, depending on how much data is available. Most vendors only convert data for the current year, but others (like us) go back further, if desired.

Flexibility

A bucket data conversion is not as flexible because it involves migrating data in predefined clusters. Transactional conversions, on the other hand, are more flexible because they migrate individual records. You can determine the details that you want converted. This allows for more customization and more accurate records that will help with financial planning. Bucket conversions are quicker though, so if you’re looking at timing flexibility, bucket conversions might be a better option.

What We Do

We usually provide transactional data conversions when we can. We are unique in this regard. However, if other vendors won’t provide detailed data, or if you are looking for a quicker turnaround, we provide bucket conversions as well.

Our data conversions provide the ability to go from check number to invoice to vendor to bank, etc., without missing a beat. We include all of your information for two years in the past, with an option of extending that amount of time (we’ve even converted 20+ years of financial data for some customers). Sometimes, we don’t even need the cooperation of previous vendors to enact a transactional conversion, so talk with our regional managers about what a conversion might look like for you.

Conclusion

Overall, the choice between a transactional data conversion and a bucket data conversion depends on the specific needs, timing, and requirements of the organization. Factors such as data complexity, time constraints, and data integrity concerns can all impact the decision. Whether you choose bucket or transactional, it’s important to know the difference so that you can thrive in your next onboarding experience.

Contact Us